Browse my projects

Financial Statements Reader

Developed an algorithm to extract and transform publicly available quarterly and annual financial reports into tabular data, overcoming limitations of the EDGAR API such as data inaccuracies and query limits. Leveraged NLP techniques in conjunction with Google Cloud's computer vision models to automate data extraction from PDF reports. Integrated seamlessly with a MS SQL Server for scalable storage and query capabilities, enabling analysis of records. Technologies used: Python, OpenCV, NLTK, Google Cloud Vision, MS SQL

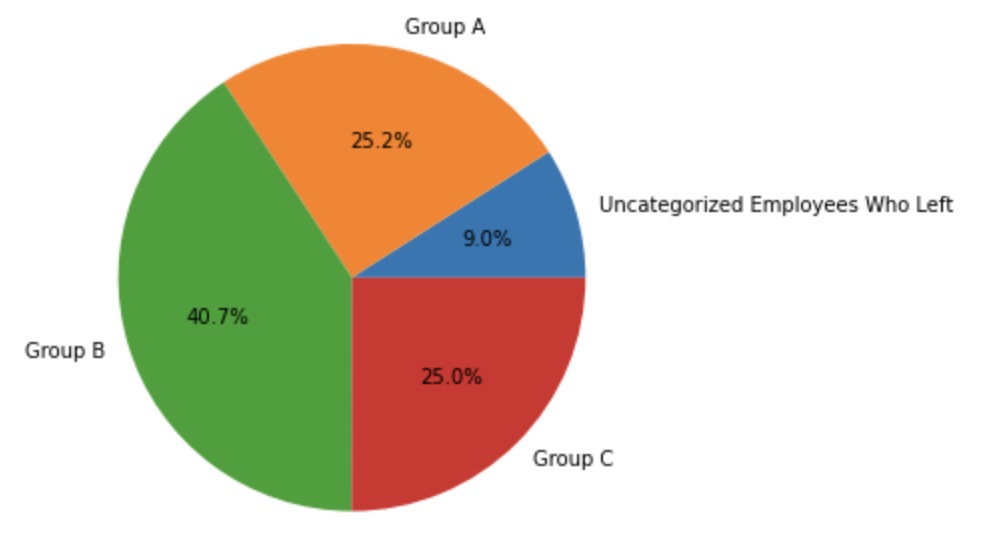

Sailfort Motors - HR Analytics

Analyzed employee turnover rates at a fictitious automotive company by creating 6 employee profiles using quantitative metrics. Leveraged visual analytics and machine learning to identify inefficiencies in employee retention, with insights geared toward reducing churn. Fine-tuned a random forest classifier using features such as job satisfaction and tenure, achieving 99% accuracy in predicting turnover outcomes. Results were communicated through explainable visualizations to support data-driven HR decisions. Technologies used: Python, Pandas, Matplotlib, Seaborn, and Scikit-learn.

SuperRare CryptoArt Marketplace Analysis

Conducted a quantitative analysis of the 2022 NFT market craze by assembling a custom dataset of blockchain transactions, cross-referencing multiple chains to validate transaction accuracy. Aggregated complex transaction data into a unified dataframe for comprehensive analysis. Developed key quantitative features to uncover trends in transaction volume, pricing behavior, and market activity. Technologies used: Python, Pandas, Selenium, BeautifulSoup4

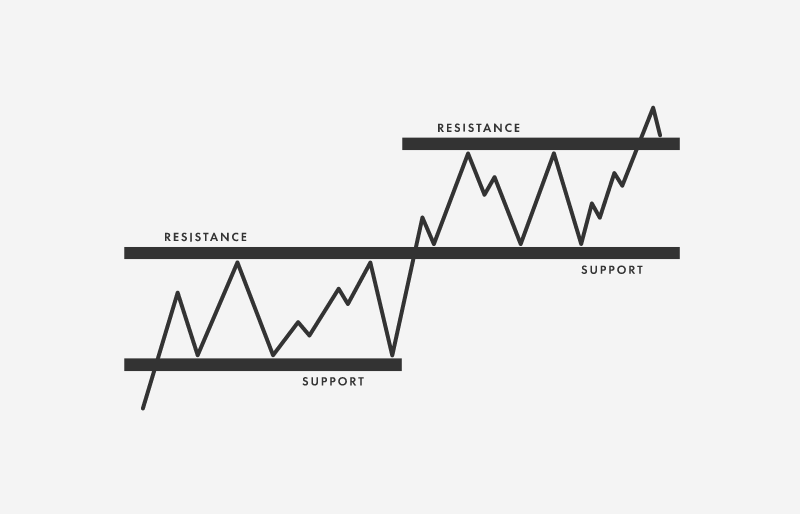

Critical Price Levels Identifier

Developed an algorithm to identify critical price levels in market data using calculus-based approaches with FinDiff and NumPy libraries. The algorithm was successfully backtested with proprietary trading strategies and enhanced decision-making through integration with technical analysis techniques such as moving averages and RSI. Backtesting results showed improved trade timing and risk management. Technologies used: Python, NumPy, FinDiff

Polygon API Financial Data Retrieval and Processing

Automated the retrieval of financial data from the Polygon API, ensuring data accuracy by cross-referencing it with external sources. Applied data cleaning techniques to adjust for common errors and inconsistencies in the API's results, improving the reliability of financial insights. Technologies used: Python, Polygon API, Pandas

Prototype Banking Application

Developed a prototype banking application for CS50P’s final project, simulating core banking functionalities such as transaction processing and account balance management. Leveraged NumPy and Pandas for efficient data handling and calculations, providing a robust foundation for financial operations. Technologies used: Python, NumPy, Pandas